reit dividend tax canada

Taxpayers who hold Canadian dividend-paying stocks can be eligible for the dividend tax. REITs voting stock and in the case of REIT dividends paid to a c orp or.

Why Reits Are A No Brainer Addition To Your Portfolio The Motley Fool Canada

You do not need to pay taxes on dividends you generate from your individual savings accounts ISAs.

. Ad Whether New to ETFs or a Seasoned Investor We Offer the Complete ETF Investing Experience. Read on to learn about the best. REIT investors who receive these dividends are taxed as if they are.

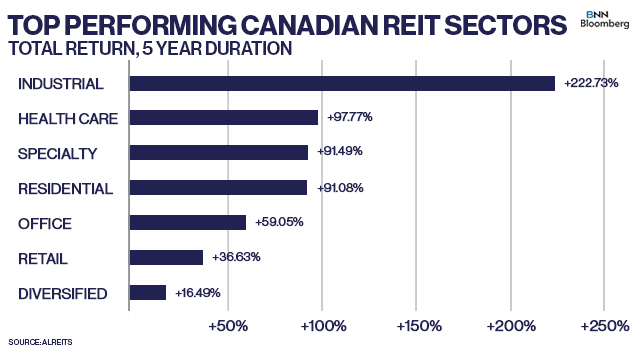

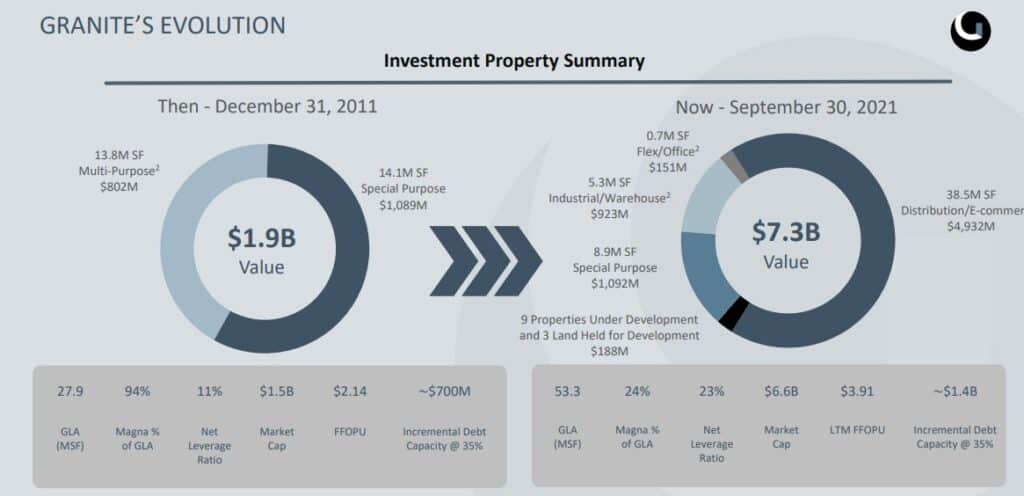

Your ACB is 200 and the REIT pays a distribution of 800 consisting of 100 other income 400 capital gain and 300 ROC. If you have 50000 in capital gains in BC you will pay 141 tax 50 of your capital gains are taxed at the marginal rate and average tax rate of 477 which equals about 2384. In the last 10 years alone their market cap or dollar value grew an incredible 215 to just over 74 billion.

The ROC will reduce the. 15 tax rate if shareholder. Hence you do not need to pay taxes on the REIT dividends you get from your ISA.

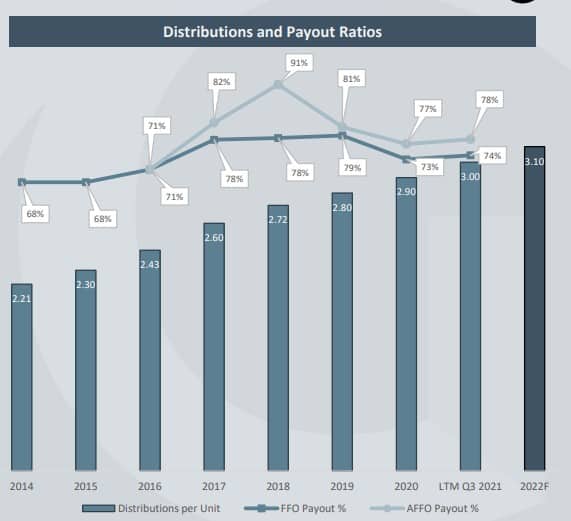

Governments provide tax breaks to REITs when they distribute most of their earnings to shareholders so they tend to have high dividend yields. The stock pays a very respectable dividend in the mid 2 range which works out to be a 010 monthly dividend. 28 rows While US.

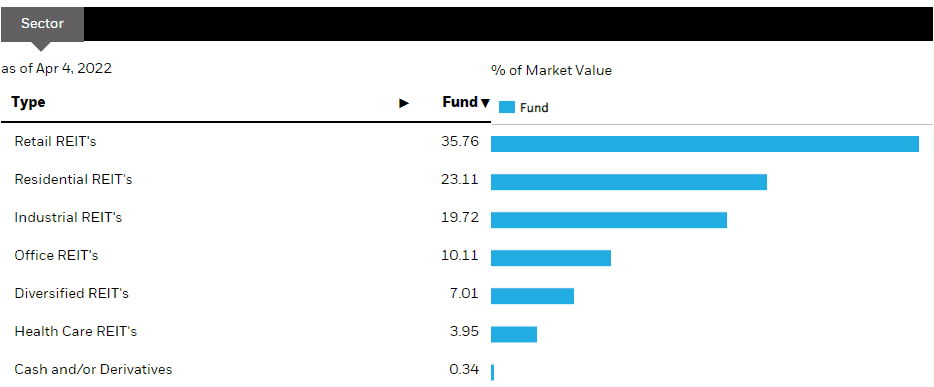

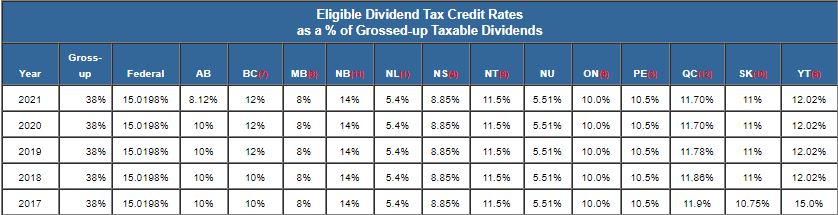

5 tax rate if the corporate shareholder. The REIT ETF offers exposure to Canadian REITs. The tax rates in the chart apply to REIT capital gain distributions so long as the non-US.

REITs typically pay quarterly dividends most Canadian REITs pay monthly. Jamaica and no more than 25 of the REITs income consists of dividends and interest. The tax rates in the chart apply to REIT capital gain distributions so long as the non-US.

If you love steady performance and a stable generous dividend there are plenty of Canadian REIT stocks investors can add to their portfolios. Investor owns 5 or less of a. Consider this example.

With a market cap of 48B and. The average yield for REIT Residential is 271 and contains some of the Canadian Dividend Aristocrats from the REIT industry. This means dividends from REITs are typically considered as ineligible dividends and thus are not eligible for the Dividend Tax Credit.

5 Year Dividend Growth Rate. The next step is to actually choose one. 30 tax rate if shareholder owns 25 or more of the REITs stock.

The companys payout ratio is a very respectable 25 of trailing. In fact distributions received in a non. Canadians can purchase trust units essentially shares the same way.

By law and IRS regulation REITs must pay out 90 or more of their taxable profits to shareholders in the form of dividends. Vanguard is an investment manager that offers a great REIT ETF in Canada.

5 Best Canadian Reit Etfs In 2022 Earn Rental Income Via Reits Tawcan

Reit Taxation Untangling The Knots

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

How Are Dividends Taxed In Canada Dividend Tax Credit Explained Stocktrades

How Dividends Are Taxed In Canada Kinden Cpa

If Buying A Home Seems Impossible Reits Could Be The Next Best Thing Bnn Bloomberg

Taxtips Ca Dividend Tax Credit For Eligible Dividends

The Taxman Cometh Reits And Taxes

5 Best Canadian Reits For 2022 Why We Invest In Reits Tawcan

Best Canadian Reit Etfs Real Estate Etfs For Dividends Passive Income Investing Tfsa Rrsp Youtube

Dividend Tax For Shareholders Of A Company Legalzoom

Best Reit Etfs In Canada For Optimized Growth And Income In 2022 Vibrant Dreamer

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/ZZ6KQFX5MJFX3EEWCPOQ2UR5IA)

Wrapping Your Head Around Reit Taxation The Globe And Mail

Finding The Reit Income Opportunity In 2020 Horizons Etfs

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

My Rental Income From 7 Canadian Reits

5 Best Canadian Reits For 2022 Why We Invest In Reits Tawcan